The Sunshine Law was signed in the United States in 2010 as a part of the Affordable Care Act. This law demands that manufacturers and certain distributors track and report certain payments and transfers of value made to physicians and teaching hospitals; in addition, the manufacturers, GPOs and distributors are required to report certain investment interests that are held by physicians or their family members.

The Sunshine Law was enacted to ensure the transparency of the relationships between physicians and commercial companies and manufacturers of medical equipment, drugs etc. This law, however, does not limit physician-industry collaborations or interactions or prohibit payments, but rather requires reporting of the data regarding these interactions.

Additional information can be found at the official CMS website for the Sunshine Law:

The Sunshine Law schedule

- August 1st, 2013: Companies and manufacturers must start collecting data regarding ownership interests, payments, and transfers of value.

- March 31st, 2014: The companies and Manufacturers should submit the report, which must cover ownership interests, payments and transfers of value for the months of August 2013 – December 2013. Information for the rest of the year will be presented in successive reports that should be submitted by the 90th day of the following year.

- August, 2014: Teaching hospitals and physicians can review and correct their own data through a secured online portal. The review and correction process may take up to 45 days, and additional 15 days may be provided to resolve all controversies discovered. In the following years, this stage will take place in May.

- September 30th, 2014: CMS will publish the information collected in 2013 on a public website. In following years, this stage will take place on June 30th

Who is required to report?

The following are required to submit Transparency Reports to CMS every year, regarding payments and/or transfers of value given to Teaching Hospitals and/or Physicians: Manufacturers of drugs, medical devices, biological or medical supplies, which operate in USA, including certain distributors, wholesalers and entities under common ownership (5% or above) with a Manufacturer.

Payments and transfers of value that must be reported

All payments and/or transfers of value, including those made through a third party, to Teaching Hospitals and/or Physicians.

All payments and/or transfers of value made by, on the request of or on behalf of Teaching Hospitals or physicians. Reports should include the name of the third party.

The Sunshine Law applies to all the types of doctors listed herein, as long as they hold a valid license to practice medicine in USA, regardless if they are or are not enrolled in Medicare, Medicaid or CHIP:

- Doctors of medicine

- Doctors of osteopathy

- Dentists

- Podiatrists

- Chiropractors

- Optometrists

- Fellows

Residents and Allied Health professionals, including residents in medicine, dentistry, podiatry, osteopathy, optometry and chiropractic, are not included in the requirement.

What must be reported?

Payments and transfers of value must be reported if the value of the item is 10$ or more. If the value of each item is under 10$, reporting is mandatory if the sum of all the items which were given to a specific recipient over a year is 100$ or more.

Both direct and indirect payments or transfers of value must be reported, as well as payments or transfers of value that were given to a third party on behalf of or at the request of a physician and any payments or transfers of value which were given to the owner or investor of a Physician.

Ownership/investment interests must be reported if they are held by Physicians or any of their immediate family members, in GPOs and Manufacturers. The amount invested in dollars must be noted, as well as the terms of ownership or investment interest (apart from interests in mutual funds or publicly traded securities).

Details that must be included in the report

- Name of the Manufacturer or GPO.

- Name of the Physician and business address.

- Specialty, NPI and State Professional License number.

- Value in dollars and date of the payment or transfer of value.

- Form of payment or transfer of value – cash, cash equivalent, in-kind items or services, stock, stock options or other ownership interests, dividends, profits, other return on investment etc.

- Nature of payment or transfer of value:

- Consulting fee.

- Honoraria

- Gifts.

- Compensations for serving as personnel or as a speaker for a certified or accredited CME (Continuing Medical Education) program, or for a non-certified or unaccredited CME program.

- Compensations for serving as personnel or as a speaker for for a non-certified or unaccredited CME program.

- Compensation for services, including serving as personnel at events other than a CME program.

- Food and beverages.

- Travel and accommodations (destination should be included).

- Entertainment.

- Research

- Education.

- Charitable contribution.

- License or royalty.

- Grants.

- Rental of space or facility fees (for Teaching Hospitals only).

- Ownership or investment interests, current or prospective.

- Name of the product or device, therapeutic area or product category related to the payment or transfer of value.

- (Optional) A brief description of the context in which the payment or transfer of value were provided.

- If the product was not given directly to the physician, name of the entity which received the payment or transfer of value.

- Whether the Physician which received the payment or transfer of value, or any immediate family member, holds ownership/investment interests in the Manufacturer providing the payment or transfer of value.

- Payments that are related to research must be reported separately. The report must be submitted on the year of the payment and state the name of the institution and the principal investigators in charge of the research. Some of these details may qualify for delayed publication to the public CMS website.

Data corrections by the physicians

Physicians will receive 45 days to review the submitted information before the data is posted publicly. The personal data for each physician may be accessed by a secure online portal which will open for inspection by CMS. In case of need, 15 additional days will be provided to solve disputes and reach a solution.

If, after the 15-day period, the disagreements will not be resolved, the data will be publicly published on the website and will be flagged as “disputed”.

Physicians will be able to request corrections or contest the disputed report for a period of two years after access has been granted.

Publication of the reports

The majority of the information in the Transparency Reports will be published in a public website once a year.

Data from 2013 will be published on September 30th, 2014. In the following years, information will be published on June 30th.

The HHS Secretary will also be required to report annually to Congress.

The Sunshine Law and physicians/ Teaching Hospitals

Physicians and Teaching Hospitals are not subjected to penalties or obligations, including reporting obligations, under the Sunshine Law, and it applies to applicable Manufacturers and GPOs only.

Payments and transfers of value that are excluded from the obligation to report

There in no obligation to report payments or transfers of values which fall into these categories:

- For speaking at a Continuing Education Program, if the following three conditions are met:

- The program received accreditation/certification according to the requirements and standards of AOA, AMA, ACCME, AAFP or ADA CERP.

- The manufacturer does not pay the physician speaker directly.

- The Manufacturer does not select the speaker or provide a list of persons to be considered as speakers.

- For existing personal relationships (such as spouses, one working for a Manufacturer and one working as a physician, giving gifts to each another).

- For education-related materials that are intended for the use of patients or benefit the patients directly.

- When the value is less than 10$ and does not exceed 100$ for the whole year. This amount will be adjusted in the beginning of 2014 with the consumer price index.

- Rebates and discounts.

- In-Kind products provided for charity care.

- Product samples, including vouchers and coupons, when they will be supplied to patients. A written agreement is required.

- Products, items or services that are provided under service and maintenance agreement or contractual warranty.

- Evaluation and demonstration units, when they do not exceed 90 days of average daily use.

- When received by the Physician as a patient or a subject of research study.

- For provision of healthcare services provided to the employees of the Manufacturer or their families (such as on-site clinic).

- For services regarding a civil or criminal actions or administrative proceedings (such as an expert witness).

- For nonmedical, licensed professional services (such as a physician-attorney which is paid to provide legal services only

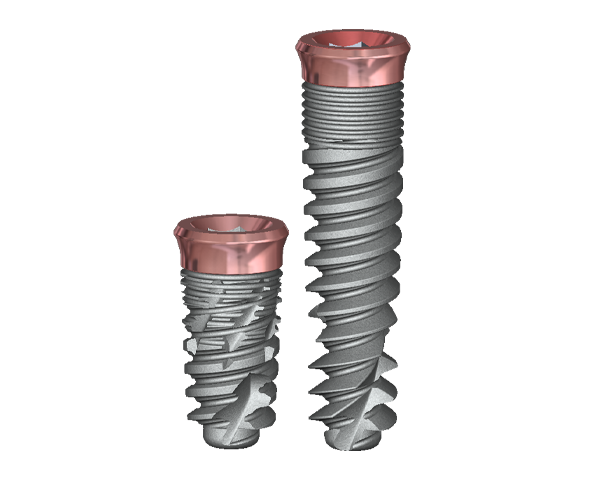

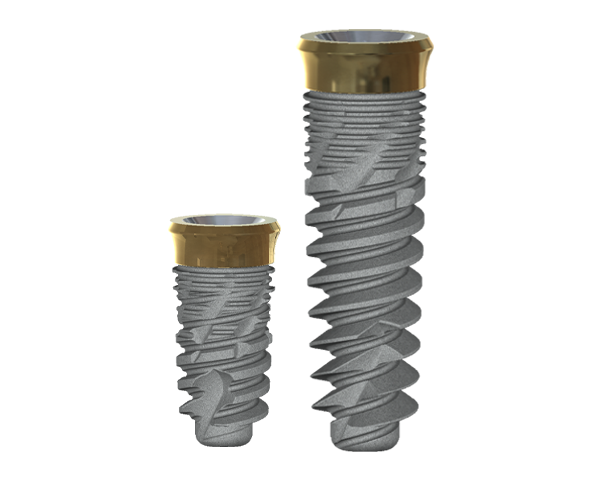

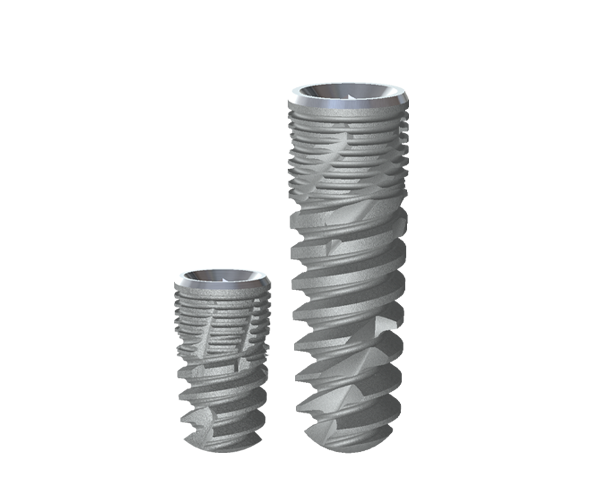

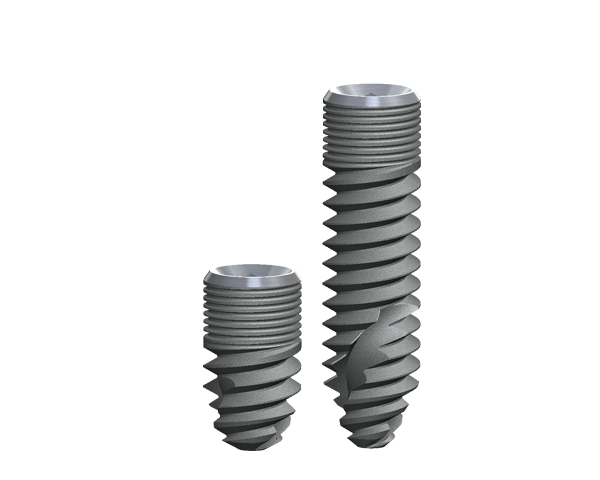

The combination of innovative surface technology with 344% stronger bone reduces marginal bone loss and provides for a higher BIC%, decreasing

the risk of peri-implant disease. The enhanced deep thread

simplifies the insertion and allows for high primary stability.

A wide variety of implant systems are offered in order to

suit the widest range of bone densities. Our technologies

are constantly being updated to offer a range of parts that

allow the flexibility that is vital to achieving the most

aesthetically pleasing results.

The combination of innovative surface technology with 344% stronger bone reduces marginal bone loss and provides for a higher BIC%, decreasing the risk of peri-implant disease. The enhanced deep thread simplifies the insertion and allows for high primary stability.

A wide variety of implant systems are offered in order to suit the widest range of bone densities. Our technologies are constantly being updated to offer a range of parts that allow the flexibility that is vital to achieving the most

aesthetically pleasing results.